How to save Money in a SMART way

Do you have financial goals? Saving will undoubtedly help you achieve them. Learning ways you can save will make managing your finances and achieving your goals easier. Here we tell you how to combine SMART goals with other strategies for more intelligent saving.

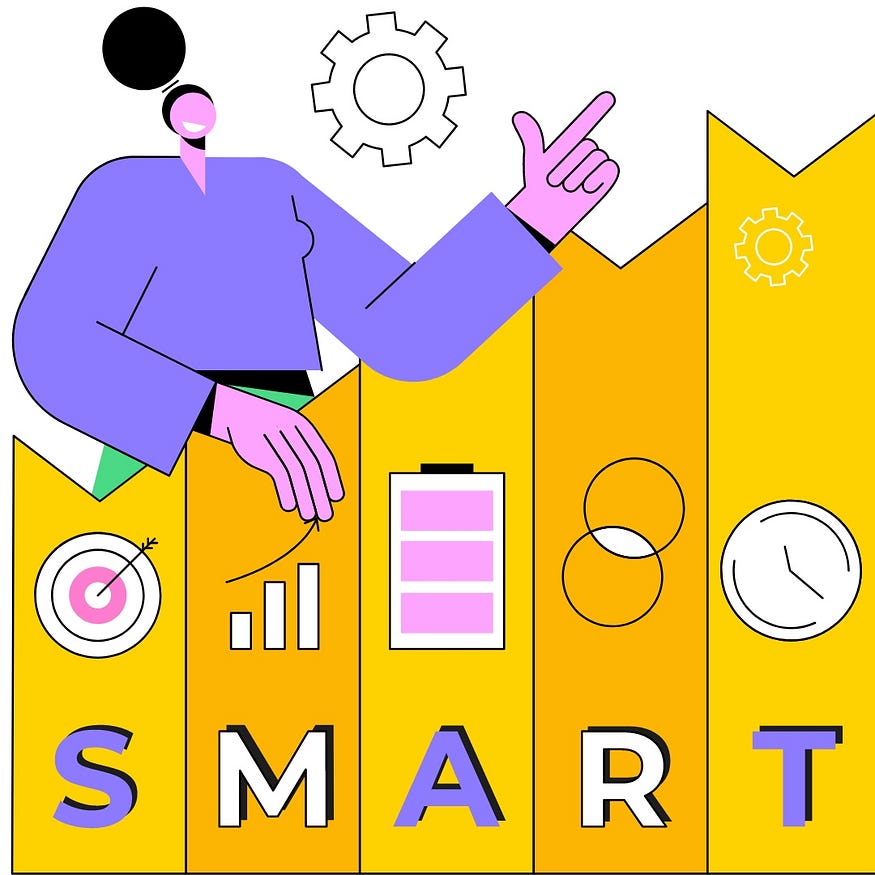

SMART is a well-known method of setting career goals. Knowing what each letter of this acronym means is key: S for “specific”, M for “measurable”, A for “achievable”, R for “relevant”, and T for “time-bound”. As the acronym suggests, it’s about using reason to make better decisions.

You can use SMART goals for personal finances. Saving is undoubtedly a major factor in helping you reach your financial goals. Knowing how to rein in your spending is not easy. You might think you need to earn a lot to be able to save. However, your salary is second to how you manage your money.

Below are some SMART method tips to make reaching your savings goals that little bit easier:

1. Keep a reminder of what you want to achieve

You can either save up for something or for no reason at all. Thinking of what you want to save for is the first step. If you want to buy a phone or car, check price comparison websites and apps to learn about market rates, benefits, consumption, fuel type and other things.

When you settle on a particular model, why not set a picture of it as your computer or mobile screensaver? That way, you will have a constant, visual reminder of your goal to help keep you motivated.

2. Weigh up the pros and cons of your goal

Have you ever paid for a product or service you later realized you didn’t need? Most of us have, even though it can hurt our financial health. To find out whether a savings goal is right for you, draw a line down the middle of a page. On one side, jot down the benefits of achieving the goal; on the other, list the drawbacks. The outcome will help you decide if the goal is worth pursuing.

Using the car example, you could think about things like how often you’ll use it, whether you have somewhere to park it, alternative ways of getting around (bike, metro, bus, etc.), and the cost of insurance and upkeep. The more benefits you come up with, the more important or necessary the car will be, and the more motivated you’ll be to get it. On the flip side, if it’s not a priority, you might lose interest shortly after starting to save.

3. Draw up a budget to find out how achievable your goal is

Setting a financial goal requires knowing where you’re at financially. Drawing up a monthly budget will let you know how much you’re able to save. You can use a pen and paper, Excel spreadsheet, app or website to track your income and expenses on things like rent, food and transport. If there’s anything left at the end of the month, you’ll be able to put it towards your savings goal. To keep costs down, you can stick to a shopping list to avoid overspending, or buy and sell second-hand goods on apps.

If you’re aiming high, like saving for a house deposit, it’s a good idea to break your goal down into chunks. You could reward yourself for reaching milestones and stay motivated to reach the next one.

4. Track your progress

When setting a savings goal, you should think about how to track it. Some online banking apps enable you to create piggy banks for your goals. You can give them names, like “Car purchase”, and tag them with a picture. You can also see how you’re doing in the form of a progress bar.

Depending on how much you want to save, you could even use a piggy bank you can drop cash into and keep a record of your contributions. To encourage your little ones to save, why not get them to draw what they’d like to buy and gradually colour in their creation when they reach each milestone. Whatever you choose, being able to see how close or far away you are is key.

5. Prepare a schedule

The timescale you set for your goal is crucial. Plan ahead, set your financial priorities and tailor your spending to your goal. Use your devices’ calendars to highlight the dates you want to put money aside. You can also set an alarm or reminder.

Managing your SMART goals using traditional or digital means will help you stay on track to get where you want to be more efficiently. Achieving your financial goals hinges on the method you use to save money.